November 10, 2015

Possibly the Biggest Story You Haven't Heard About

One of the after-effects of the 2008-9 economic downturn was a drop in the price of aluminum. Unsurprisingly, this is having a deleterious effect on the American aluminum industry. simply a market contraction and ought to be self correcting, if highly irksome to aluminum workers on the low end of various seniority lists.

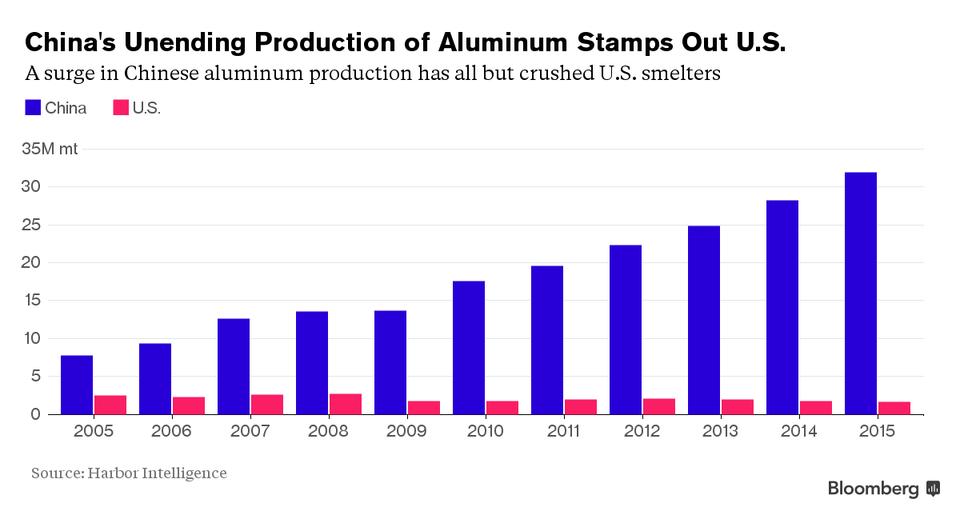

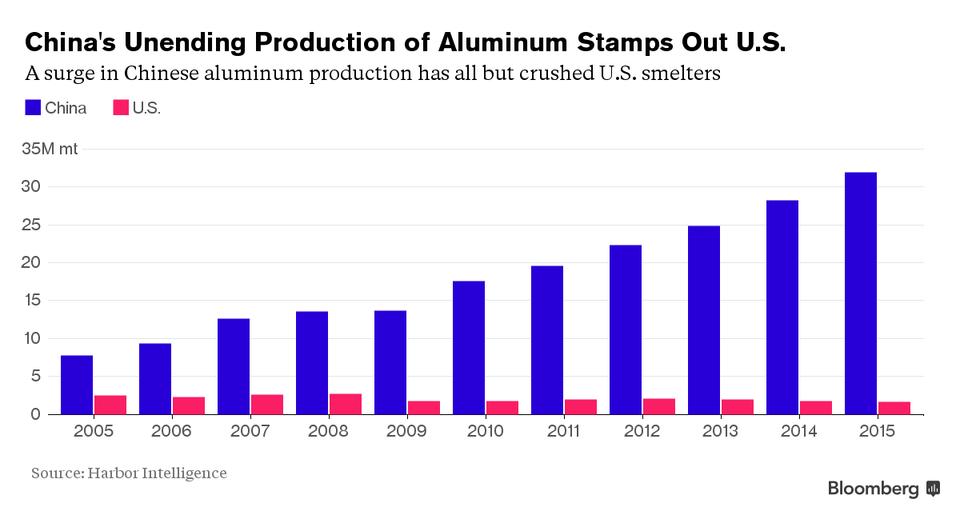

While the price of element 13 continues to plummet, China is ramping up production in a big way.

Really Really Big

While competition driving down prices is generally a good thing, there are some problematic implications here...

Now, with prices languishing near six-year lows, it’s wiping out almost a third of domestic operating capacity, Harbor Intelligence estimates. If prices don’t recover, the researcher predicts almost all U.S. smelting plants will close by next year.

(Emphasis mine)

Some of this is simply inevitable market forces. China has lower labor costs and advantages in scale. However the surge in production during a massive Al glut is most likely a government funded endeavor to kill worldwide competition. It should be noted however, that domestic policies which cause energy prices to " necessarily skyrocket" are an insurmountable hurdle for an industry that requires a huge amount of electricity. Thus the industry is being hit from both sides.

There are, additionally, issues beyond the strictly economic ones.

Aluminum is a strategic material despite its abundance. If everyone has to import their Al from China it could lead to problems.

Should the supplier not be forthcoming for some reason, domestic production might take a bit of time to spin up; perhaps too long to be relevant in the context of a short, sharp war.

Posted by: The Brickmuppet at

01:23 PM

| Comments (3)

| Add Comment

Post contains 285 words, total size 3 kb.

1

Lets look at this from the Chinese producer's POV. They're leveraged to the hilt. Their loans are backed by both the ore they have and the stockpile of finished product they make. What's the bank going to do, repossess a bunch of fast depreciating commodity?

Posted by: BigFire at Tue Nov 10 13:48:22 2015 (O7l6D)

2

China also outproduces us massively in terms of steel production. But the steel they produce is absolute crap. A metal's true yield strength is a very strong function of how it is made - you could have stuff fail at a 10th or a 100th of the yield strength of a metal with well-controlled composition. What we call "steel" today is far more reliable and uniform in it's properties (and therefore can be loaded far higher, rolled thinner, etc) than what we called "steel" in 1800.

What China makes is "vaguely ferrous stuff". I had a friend with a cast-iron vise from Harbor Freight which brittle fractured into tiny little pieces when a hundred pounds of compression was applied to the grips.

Do you want these guys making aircraft structural metal? Hilarity *will* ensue.

What China makes is "vaguely ferrous stuff". I had a friend with a cast-iron vise from Harbor Freight which brittle fractured into tiny little pieces when a hundred pounds of compression was applied to the grips.

Do you want these guys making aircraft structural metal? Hilarity *will* ensue.

Posted by: ams at Tue Nov 10 15:39:41 2015 (GtPd7)

3

And yet, Chinese space boosters are among world's most reliable and economical.

Posted by: Pete Zaitcev at Wed Nov 11 14:32:58 2015 (XOPVE)

35kb generated in CPU 0.0175, elapsed 0.0969 seconds.

71 queries taking 0.0848 seconds, 382 records returned.

Powered by Minx 1.1.6c-pink.

71 queries taking 0.0848 seconds, 382 records returned.

Powered by Minx 1.1.6c-pink.