April 13, 2025

More on Tariffs and Such

UPDATE: I'm ideologically and philosophically skeptical of tariffs as a concept. However, free trade is a two way street, and there are countries that have tariffs on out goods of over 200%. So I'm at least open to the concept.

However, a trade war, particularly given how shaky the global economy is right now, it a quite scary prospect, so there are good arguments for not picking at this scab right now.

On the other hand it is vanishingly unlikely that there will ever be a time to reset global trade to something sane that will not involve risk. This is akin to the conundrum cities face with getting rid of rent control. Trump is term limited and no other president is likely to pursue this with any degree of enthusiasm, so a whole host of counterarguments can be made that it's now or never.

On the gripping hand the people crying most loudly about this are not folks who have been free traders historically, but are people who seem VERY upset at having their rice bowls tipped over. Oppositional Defiant Disorder is not a valid political strategy, but when our tormentors are THIS upset by something, that something should at least be looked at closely. While it is more likely that they are enraged at the loss of their cushy sinecures and their many investments at our expense, it is actually possible that their very different perspective on reality might have given them an insight into something that is a blind spot for us. Both possibilities need to be looked at, but time is running out.

The future is an unlit road, we are driving down it with no headlights and the gas pedal on the floor. Let us pray that the ultimate destination is pleasant, for the drive is likely to be bumpy.

Posted by: The Brickmuppet at

01:16 PM

| Comments (1)

| Add Comment

Post contains 310 words, total size 2 kb.

April 07, 2025

A.I is going to take our....Wait. What!?

Over at .Clue, J.Greely has a selection of episode reviews of anime from current week, all of which are worth reading. He also notes, as an aside, that he has been experimenting with a LLM FOR SCIENCE! and....um...

I remember when Projekt Melody's origin story was considered silly and contrived. Now I'm beginning to suspect it's actually a warning for us all.

Posted by: The Brickmuppet at

10:39 AM

| No Comments

| Add Comment

Post contains 73 words, total size 1 kb.

April 06, 2025

Tariffying

OK. I'm BACK!

more...

This is the post where I (like everyone else on the internet at the moment) am required to be an expert on international trade, monetary policy, profit margins, comparative tax and tariff structures between economies as well as between cultures that have significant but sometimes non-intuitive differences, U.S. national industrial policy, to what extent the former should or should not reflect a policy of autarky, Canadian public opinion and how it's goals differ from the actual, as opposed to the stated goals of the Laurentian consensus, U.S. agricultural exports, the effects on both global hunger as well as the viability of American farmers that are likely to result from its curtailment, the realistic potential for industrial scale recourse extraction in CONUS, the environmental cost-benefit of the same, the United States' textile industry, the relative differences and severity between inflation that is due to product scarcity and that that is caused by overprinting of fiat currency, the carbon footprints produced by burning various models of Tesla vehicles, how fast new businesses and infrastructure might be built in the U.S., the political will of several other countries, the domestic political costs those other country's governments will incur regarding any trade concessions they might or might not make, the effect of economic tensions between potential allies in a time of global instability, and the effects of U.S. excise taxes upon penguins.

Sadly, unlike every other person on the internet right now, I have shameful gaps in my knowledge of many of those topics.

My qualifications are that I possess a degree in history, am a nerd, have a website and internet access so I can do a bit of research via mostly secondary and tertiary sources. Research Gate provides numerous peer reviewed papers on economic policy regarding aspects of the current topic which I am not particularly qualified to assess, and none on the current topic itself as it is a developing story.

So:

I'm gonna wing it.

I'm not gonna lie.

At the moment, my pucker factor is high.

I'm a conservative. I've been one all my life, never having gone through a liberal phase as such. (That's what growing up in the '70s will do to you. ) As such I have always been generally opposed to tariffs. Part of this was just tribal, as the left always extolled the virtues of tariffs. However, there is both a practical and a historic basis for my tariff skepticism, quite apart from the ideological theorizing of the Chicago School of Economics.

The practical opposition is mostly anecdotal and comes from my experiences as a child growing up in the 1970's and as a teenager in the 80s. U.S cars were absolute crap. Unreliable, and prone to astonishing rates of rust. My folks, who lived in the rural, costal southeast purchased numerous vehicles which rusted out with impressive alacrity*. All that changed when they got a Toyota Corolla. It ran reliably right up until my dad was attacked by a vicious tree which completely totaled the car, and yet it saved my dad's life. The next car served the family for 15 years, eventually becoming my first car until, at age 19, I was attacked by a vicious tree, while minding my own business at 70mph in a rainstorm. (My family has a fraught history with foliage). Anyway, I was uninjured. My Father also got a superb light truck, an Isuzu Pup diesel, which despite having been submerged twice in seawater (hurricane storm surges, literally attacks by vicious water) immense wear and tear, 2 collisions and a need to make spare parts from scratch is still serving my dad 40 years later, albeit intermittently and with some of it's metal structure replaced by lumber. The reason for this is not only because of the remarkable durability of 'Woody' but because tariff restrictions put in place since the 1980's due to the Japanese making light trucks of vastly superior quality to their American counterparts. The result of those restrictions which included a 25% tax on imported trucks, raised all the prices by 25% and made it exceedingly hard and expensive to get a good light truck.

These restrictions left a particularly bad taste in my mouth because the furor over Japanese Imports and demands for tariffs were hand in hand with grotesque racism aimed at the Japanese (our allies at the time in the existential struggle that was the cold war.) I grew up in the south in the 70's and '80s and was quite aware of how bad racism could be, and the disgusting hate directed at Asians during the 80's and into the '90s was quite the eye opener. I witnessed it first hand during my early years at university, when a very liberal host family who gave room and board to exchange students ( and included a U.A.W. member) reacted with horror and verbal abuse to receiving a Japanese exchange student. They kicked him out on the street and I was tasked with getting him assistance...that was a story in itself, but it cemented in my mind that the tariffs touted as "PWOTKTIN' DA GOOD PAYIN' UUNOION JOBZSEZ" were little more than payoffs to resentful lazy shithead racists annoyed they had to compete with folks possessing work ethics.

These observations are entirely anecdotal as well as being based on a control group of one racist shithead, so they lack academic rigor and any fairness to the rank and file of US autoworkers, but the sentiments that I witnessed were the same ones that led to the murder of Vincent Chin.

A more relevant and rigorous reason for concern at Trump's tariffs than the gut feeling of an aging redneck is the historical precedent of the Smoot-Hawley Tariff Act, which was passed in the closing years of the Hoover administration and helped the shaky economy and stock market crash of 1929 to balloon into a devastating worldwide economic crisis. This is well documented and a cause for considerable concern.

However:

Up until this year Democrats and those on the left were at least giving lip service to the need for tariffs. They suddenly changed their tune because Trump, very much a '90s Democrat, is pushing a '90s Democrat policy, thus that policy must be cast aside.

There's also that moral issue I noted earlier about lazy people resenting people with a work ethic. The Japanese are hard for Americans to grok because of their very different culture, but the tariff issues in the 1980's could be understood as American unions and rather complascent corporations panicking because hard working workers and companies overseas had beat them at their own game fair and square. Those tariffs were AND ARE STILL punishing American consumers not in the specific industries being afforded protection.

However, what happened in the 90s was not due to worker laziness or corporate ineptitude. It was a policy by Democrats to bypass earlier restrictions intended to protect the nations defense industrial base. This seems to be in return for dumptrucks full of cash from corporate boards who were very happy to reap the benefits of "free trade" if they did not have to pay U.S. wages. It should be remembered here that the Chinese workers, to give one example, are not simply working harder and better. They are often slaves, and when not are paid exceedingly little, being residents of an increasingly totalitarian state. Besides the moral atrocity that using such labor represents, local (American) workers cannot possibly compete with such practices.

Another factor is that other countries already have pretty impressive tariffs on U.S. goods. The much ballyhooed 241% Canadian Tariff on U.S. dairy is, while inconsistent & complex, a very real thing. This and similar tariffs in Europe are a hold over from the Cold War and the Marshall Plan, when the U.S. helped rebuild the world after WW2 and bribed them with favorable trade deals in exchange for not going wobbly while we faced down a murderous empire that said it dedicated itself to world peace, but defined peace as an absence of people on the planet not under it's own ideology....and had 30,000+ nuclear warheads pointed at us.

That's not the case anymore.

And yet the foreign tariffs on U.S. exports persist.

The U.S. industrial plant has been hollowed out. This is in part due to trends that began with the healthy competition that resulted from the Europeans recovering from their self-immolation in the 40s as well as the liberation of their colonies around the world, but it is also due to policies and tolerance of policies that have meant that the U.S. has been competing on a completely unfair playing field.

National security demands that we have the ability to make our kit here and economic prosperity requires jobs that are in our country.

But the increasingly perilous international situation requires allies, and those allies, who have always looked at us with a resentful sneer now see their rice bowls (that have become THE NORM FOR THEM) being overturned. If other countries politicos agree to low reciprocal tariffs as Trump is demanding, then the political pushback to the politicians from the constituencies their unfair and abusive tariffs protect is likely to be not just hurtful at election time, but terrifyingly kinetic.

Trump is, as Churchill once said of J.F. Dulles, a bull who helpfully provides his own China shop. His actions on these tariffs is upending the world order and has the potential to plunge the planet into an economic disaster.

His constituencies are cheering, as the post WW2 order has, especially since the neo-lib ascendency after the Cold War it was intended for, devastated their lives. This is partly due to an impressive avariciousness of our ruling class but also, a fairly new but undeniable oikophobic contempt for those not of the gentry classes by many of our policy makers, captains of industry and thought leaders. Thus Trump's supporters do not put much stock in their warnings, which, however well founded they may be, are ultimately self serving pleas by their tormentors.

On the other hand IF (a big if) other countries play ball, then Trump's actions might massively revitalize the U.S. economy, provide jobs, enhance national defense, and, potentially, bring about the worldwide prosperity that actual free trade brings.

A Trump victory might also have some downward pressure on prices, as trade restrictions are lifted, though that is not likely to in any way compensate for the near to mid term inflationary pressures that a massive re-industrialization is going to entail.

To sum up, I am cautiously hopeful, but very, VERY concerned. There are many ways this can go sideways to very bad outcomes, and a few that will be wonderful....IF some pretty amazingly unlikely historical bank-shots happen.

We live in interesting times.

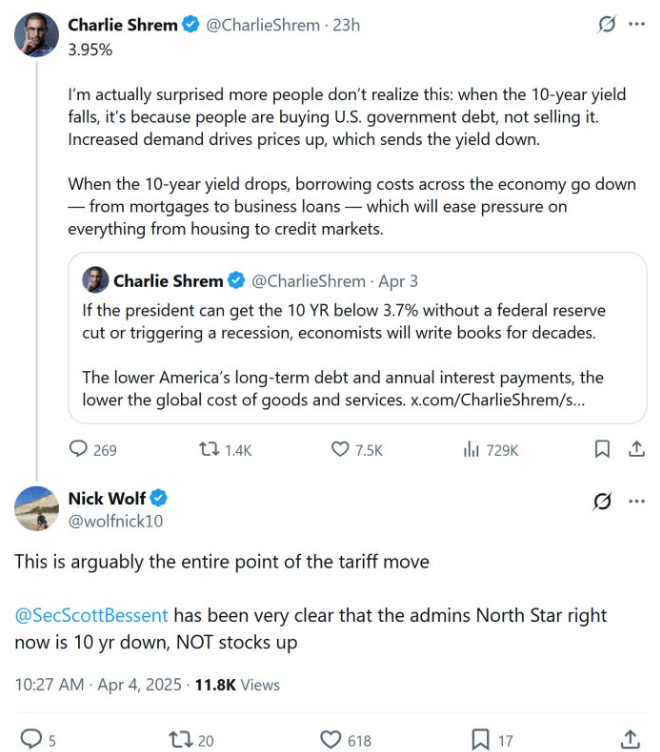

As noted above my qualifications to opine on this matter are....slim. So here are a few people who might, or might not be better positioned to make an informed observation.

Link here. I...have no idea what that means.

Bill Ackman has thoughts: Somewhat pollyannish thoughts in my opinion, but thoughts. (and his expertise is in this area)

.

@VDHanson

makes a compelling case for the

@realDonaldTrump

tariff strategy, but gets one issue incorrect. He describes the Trump tariffs as reciprocal and proportional to those other nations have assessed on us.

In actuality, the Trump tariffs were set at levels substantially above, and in many cases, at a multiple of the counterparty country’s tariff levels.

Initially, the market responded favorably, up more than one percent when Trump referred to ‘reciprocal tariffs’ in his Rose Garden speech. It was only when he put up a chart showing the actual tariffs that the markets plunged.

We can divine from this response that market participants are supportive of the administration using tariffs as a tool to lower the asymmetrical tariffs of our trading partners, but are highly concerned with tariff levels set well in excess of a corresponding country’s levels.

So why did Trump take this approach?

The answer goes back to ‘The Art of the Deal.’ Trump’s negotiating style is to ask for the moon and then settle somewhere in between. It has worked well for him in the past so he is using the same approach here.

The market’s response is due to the fear that if this strategy fails and the tariffs stay in place, they will plunge our economy into a recession. And we don’t need to wait for failure as it doesn’t take long for a high degree of uncertainty to cause economic activity to slow.

Press reports today have said that all deals are now on hold. This is not surprising. Capitalism is a confidence game. Uncertainty is the enemy of business confidence.

The good news is that a number of countries have already approached the negotiating table to make tariff deals, which suggests that Trump’s strategy is beginning to work. Whether this is enough to settle markets next week is unknowable, but we will find out soon.

The idea that Wall Street and investors are opposed to the President’s efforts to bring back our industrial base by leveling the tariff playing field is false. Our trading partners have taken advantage of us for decades after tariffs were no longer needed to help them rebuild their economies after WWII.

The market is simply responding to Trump’s shock and awe negotiating strategy and factoring in some probability that it will fail or otherwise lead to an extended period of uncertainty that will sink us into a recession.

The market decline has been compounded by losses incurred at so-called pod shops and other highly levered market participants that have been forced to liquidate positions as markets have declined.

Stocks of even the best companies are now trading at the cheapest valuations we have seen since Covid. If the President makes continued progress on tariff deals, uncertainty will be reduced, and the market will begin to recover.

As more countries come to the table, those that have held out or have reciprocated with higher tariffs will have growing concerns about being left behind. This should cause more countries to negotiate deals until we reach a tipping point where it is clear that the strategy will succeed. When this occurs, stocks will soar.

Trump’s strategy is not without risk, but I wouldn’t bet against him. The more that markets support the President and his strategy, the higher the probability that he succeeds, so a stable hand on the trading wheel is a patriotic one.

An important characteristic of a great leader is a willingness to change course when the facts change or when the initial strategy is not working. We have seen Trump do this before. Two days in, however, it is much too early to form a view about his tariff strategy.

Trump cares enormously about our economy and the stock market as a measure of his performance. If the current strategy works, he will continue to execute on it. If it needs to be tweaked or changed, I expect he will make the necessary changes. Based on the early read, his strategy appears to be working.

Let’s help him succeed. It’s the least we can do.

Over at American Greatness they have some defense of the ethics of Trump's move. Less on the repercussions.

Remember the brief mention above of "tearing the system down?" Well, Nick Freitas and crew have dome disquisitions on the matter.

Dad Saves America does a play by play of Trump's speech, and has analysis and criticism.

Over at Money and Macro, they have a more sanguine take... That somewhat comports with Freitas's stream above.

Me?

I don't know.

But I think we're in for a ride.

Posted by: The Brickmuppet at

04:41 PM

| Comments (1)

| Add Comment

Post contains 2758 words, total size 22 kb.

<< Page 1 of 1 >>

58kb generated in CPU 0.0642, elapsed 0.1557 seconds.

69 queries taking 0.1443 seconds, 381 records returned.

Powered by Minx 1.1.6c-pink.

69 queries taking 0.1443 seconds, 381 records returned.

Powered by Minx 1.1.6c-pink.